In an era defined by speed, complexity and digital disruption, commercial real estate (CRE) and property management are reaching a changing point. The industry is rapidly evolving, driven by shifting tenant expectations, investor scrutiny and regulatory pressure.

This shift is reflected in the EPRA Proptech 2024 report, which highlights a growing digital adoption, where 71.6% of companies use cloud-based CRM and 58.2% have moved to cloud accounting. However, 37.3% still rely on on-prem setups. Notably, there’s been a 46% year-on-year rise in firms seeking deeper asset and facility insights, which is now a priority for 67.2% of respondents.

Despite these indicators of change, almost 61% owners and operators depend on outdated or disconnected systems – tools that no longer align with the demands of today’s CRE environment. The cost of this fragmentation is significant – according to a recent article by McKinsey, operating with siloed systems can result in spending 10–20% more on projects due to inefficiencies. Additionally, nearly 30% of CIOs report that more than 20% of their budgets are spent addressing issues created by outdated technologies.

Spreadsheets and legacy systems no longer meet the demands of a CRE environment that requires agility, insight and real-time response.

Rethinking Property Management in the Digital Age

The traditional approach to property management and investment management relies on disconnected technologies, departments and workflows – each optimised in isolation but disconnected in execution. As a result, critical data stays siloed, reporting is reactive, workflows remain manual and strategic decisions are slowed by incomplete information. For owner-operators managing diverse asset classes such as office, industrial, retail or mixed-use, operational friction quickly becomes unsustainable. Disconnected systems not only create inefficiencies and slow decision-making but also increase the cost of data errors. Manual data entry in property systems carries an error rate of up to 47.22%, while poor integration can cost organisations $15 million (around £11 million) annually. In real estate, this often results in wasted time verifying listings, delays in closing deals and reduced client satisfaction. Therefore, the case for a unified, digital-first strategy has never been stronger.

Unified Technology for Smarter Real Estate Decisions

Digital transformation in commercial property management is not just about modernising systems. It’s about rethinking how data flows across the enterprise – from lease administration to investor relations – to create a foundation for faster decisions and stronger returns.

Yardi’s integrated solutions offer a blueprint for this transformation. By consolidating property and asset management, tenant engagement, vendor operations/payments and investment management into a single technology platform, Yardi enables real estate owners to:

- Automate repetitive tasks, save time on removing manual data errors

- Centralise information across leases, financials and portfolios

- Strengthen compliance through real-time controls and audit trails

- Drive consistency in performance measurement across asset classes

- Gain complete, real-time visibility of portfolios for all stakeholders

Yardi reduces errors because of its reliable calculation engine. The data extraction and reporting from Yardi are easily exportable – reporting is much better than previous systems we’ve used.

– Ilham Awarid, Accountant, Othrys

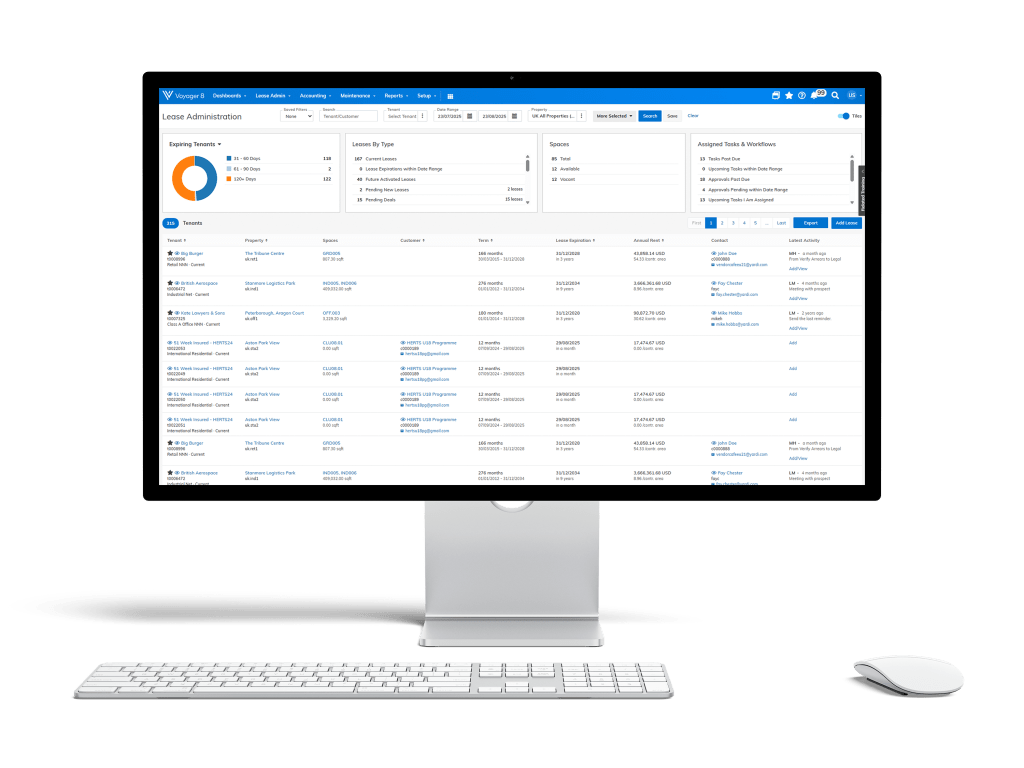

With Yardi Voyager (property management and accounting solution) at the core, organisations gain a purpose-built system for managing operations at scale. The system is powered by a robust accounting engine, lease management and reporting tools tailored for commercial assets, allowing commercial real estate operators to work more effectively rather than reactively.

On top of Yardi Voyager, there are other specialised solutions which go beyond financial reporting and further streamline workflows across key functions:

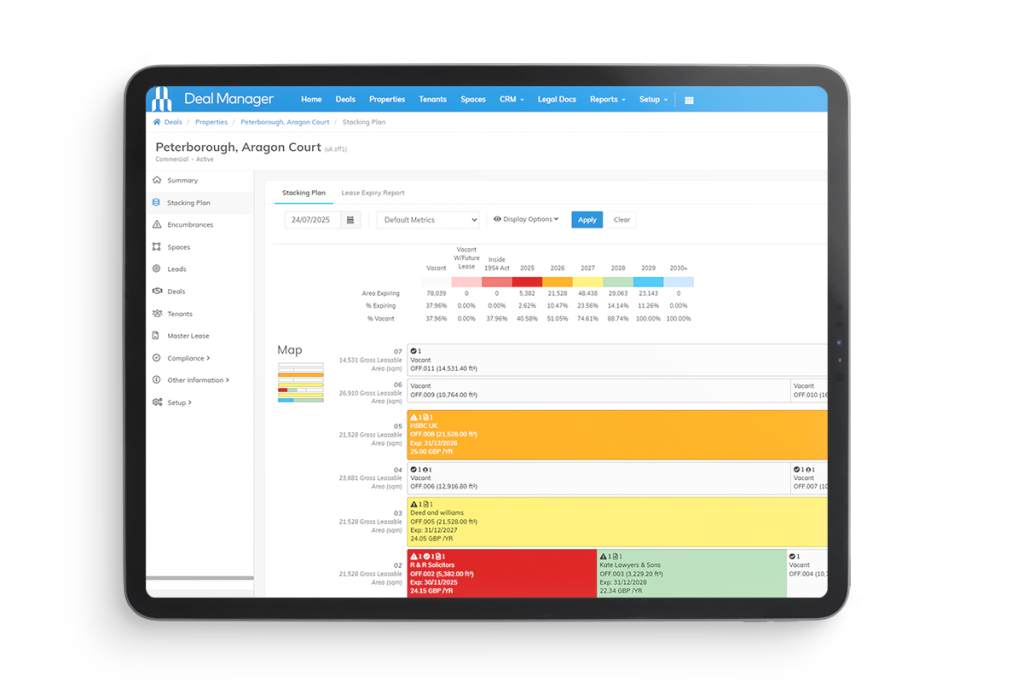

Deal Manager accelerates the leasing process with tailored automation, providing detailed lease information. Track prospects, manage negotiations and forecast occupancy outcomes in real time.

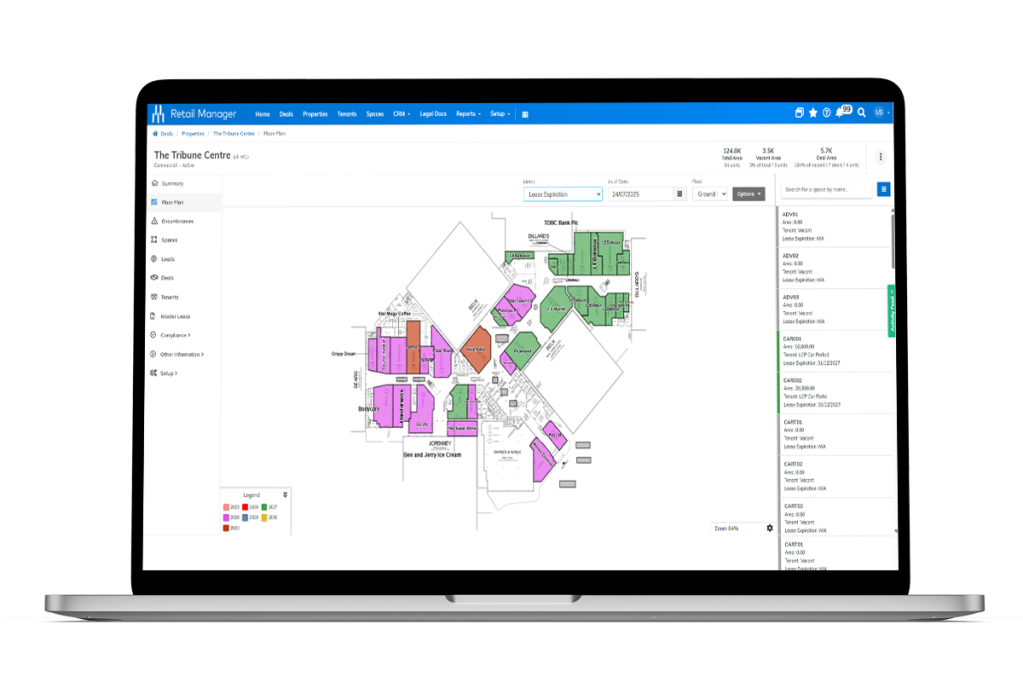

Retail Manager enables detailed floor plans and space availability information, while also providing insights into tenant sales performance.

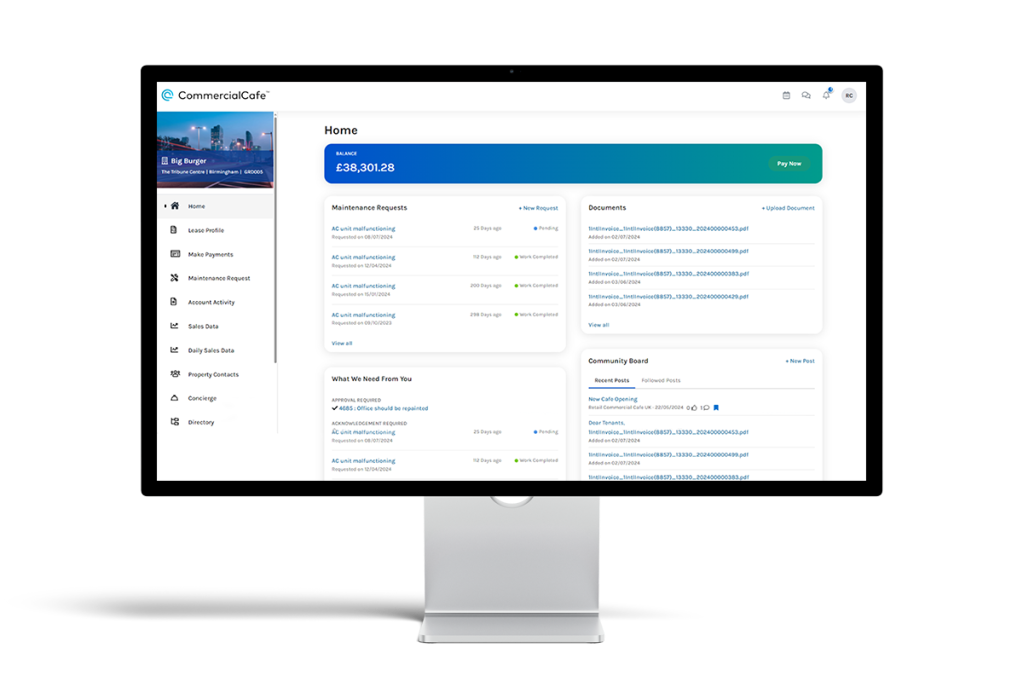

CommercialCafe streamlines the experience for tenants and staff through a self-service tenant portal and mobile app for submitting lease payments, maintenance requests and retail sales data.

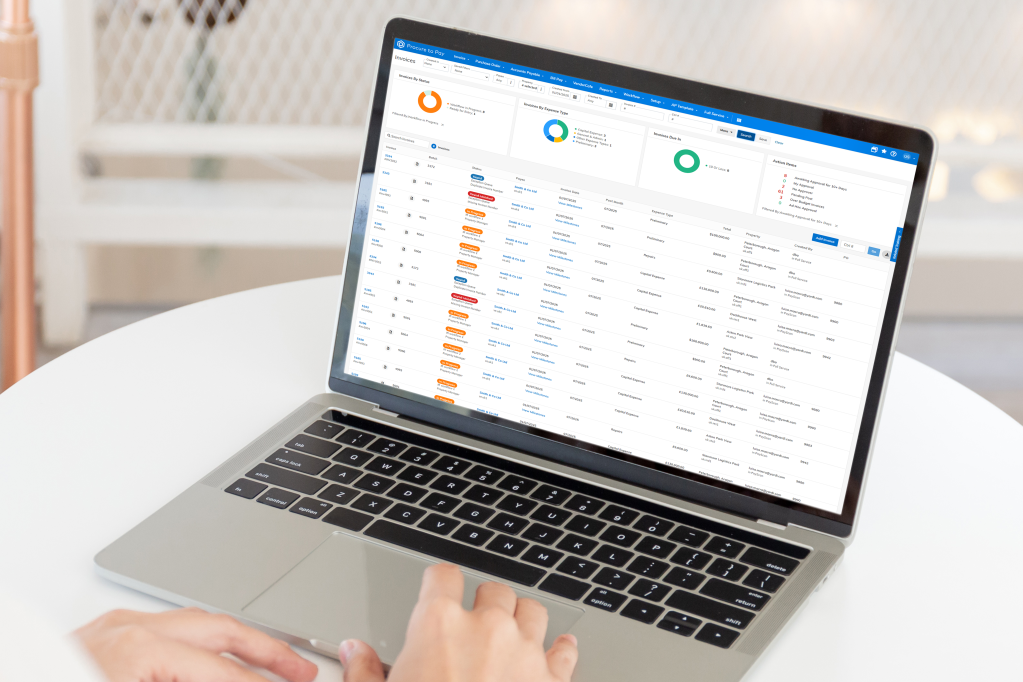

Procure to Pay & VendorCafe help efficiently onboard and manage vendor information, simplify procurement, streamline RFPs and contract approvals and enable electronic vendor payments.

Real-Time Insights with Yardi Data Connect

Perhaps the most underleveraged asset in real estate today is data. Real estate leaders hold a vast reserve of valuable information – from lease terms and occupancy trends to payment behaviour and vendor performance. Yet without centralised data access and the right analytical tools, they often stay siloed.

Yardi’s single-stack architecture changes that by unifying data across the enterprise through Data Connect. This integration brings real-time Yardi data into Microsoft Power Business Intelligence (BI), enabling users to build dynamic dashboards and uncover strategic insights.

Here’s what real estate leaders can achieve with Yardi Data Connect:

1. Business intelligence at your fingertips

Access business intelligence dashboards with numerous data points and build custom reports.

2. Operational data overview and sharing

Combine Voyager and third-party data for a complete operational view. Share secure, property-level insights with stakeholders.

3. Scalability & flexibility

Automated reporting with full data control and enterprise-grade security within your existing Microsoft Azure and Power BI setup.

Why CRE Leaders Must Embrace Digital Transformation

As the commercial real estate industry transitions towards a digital-first approach, stakeholders at every level – tenants, investors, partners and regulators – expect digital agility and operational transparency.

Meeting those expectations requires more than a system upgrade. It demands a shift in mindset. For real estate owners navigating the future of commercial real estate, the path forward is clear – unify your operations, leverage your data and empower your teams with tools designed for the complexity of modern commercial real estate.

Whether you’re managing industrial parks, retail centres, office properties or mixed-use portfolios, Yardi provides the technological foundation to help you move from operational chaos to strategic clarity – turning data into a true competitive asset.

Book a personalised demo to see how Yardi’s commercial real estate software can streamline your operations and unify your data.