The Build to Rent (BTR) sector continues to enjoy rapid expansion, both in London, regional hubs and suburban areas. Last month, Savills described investor appetite as ‘resilient’, with over £4.3 billion invested into the sector in 2022 – marking a fourth consecutive record-breaking year.

This investment, along with a 323% increase in tenant demand in BTR since February 2019, is leaving BTR operators planning for scale whilst continuing to deliver the best service possible.

As supported by the HomeViews 2023 Build to Rent report, a resource exploring insights into what residents value about their BTR communities, considering management, customer service, design, facilities, maintenance, etc., it’s clear that technology remains fundamental in delivering unrivalled customer experience and laying the foundations for scale in the sector.

Enhancing the resident experience

Yardi’s purposely designed BTR platform forms a single connected solution for property management that integrates marketing websites, online applications, CRM & leasing, accounting, procurement management, a branded resident app and more. Yardi’s end-to-end solution, currently managing 13 million rental units globally and with 500,000 daily views of its resident app, is designed to automate processes and streamline activities for an improved resident experience.

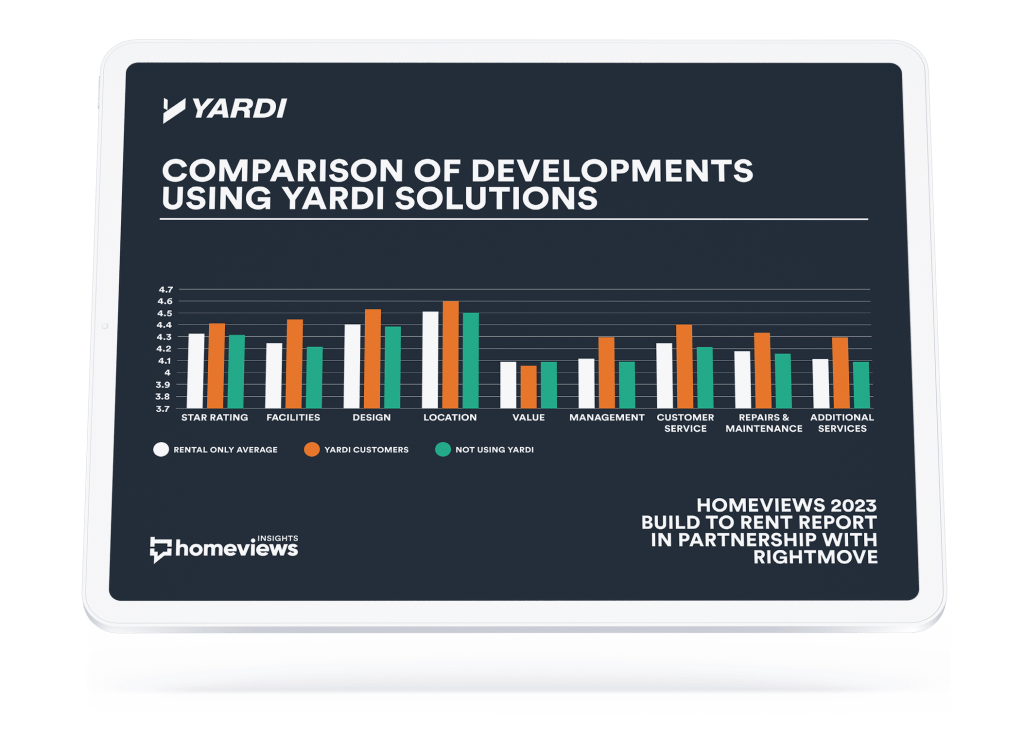

HomeViews compared ratings from BTR developments that used Yardi solutions and, out of 3,365 verified BTR reviews across 363 rental-only communities in the UK, Yardi clients scored higher than the rest of the rental only market. Of particular relevance are high scores for management, customer service, repairs and maintenance and additional services.

Developments on Yardi are rated higher by residents on the HomeViews Report for a second year in a row

The statistical correlation between technology and successful property management UK-wide highlights the importance of utilising an end-to-end solution to enhance the resident experience in BTR – from submitting an online enquiry and booking a viewing to signing a lease, setting up direct debits and, once living in a development, accessing amenities and additional services.

Laying the foundations for scale

Resident satisfaction remains a priority for BTR operators – however, as demand increases for an industry that currently makes up less than 2% of the overall property market, plans for scalability are on the horizon.

As part of the HomeViews 2023 BTR Report, Hannah Marsh, co-founder of HomeViews, spoke with Justin Harley, regional director for Yardi, on the challenges facing BTR operators and investors and how the right systems can help the industry to increase efficiency and scale.

Spotlight takeaways from the interview included:

The importance of scale

Scale is important for BTR because it brings economies of scale and a higher Net Operating Income. You can then provide a better return to whoever you raise capital from, and the cycle repeats.

It’s a volume game. It’s about margins. It’s about streamlining transactions, so your occupancy is efficient, your unit turn is low and you’re more profitable.

Barriers to successful scaling in BTR

People starting out try to keep things simple and quickly put in various software systems that link together. But if your aspiration is to go to a high volume of units, you’ll soon find shortcomings with this.

As HomeViews data has shown, larger BTR developments are achieving higher average ratings than the smaller ones. Why? Because larger developments have invariably invested in the right systems. Residents get what they need faster, and the business is set up to respond faster.

Planning for scale

As you scale, transaction volumes increase and will erode your margins unless you have automation in place. This draws capital away from more profitable activity around resident lifecycle, length of lease, extending that, etc. Maintenance, Unit Turn, Payable Invoices – all these can and should be automated.

We support different leasing journeys for different types of residential real estate across Europe. We adapt to, and invest in, a product that accommodates markets like BTR that we believe are ripe for technology innovation.

See the full story in the HomeViews 2023 National Build to Rent Report